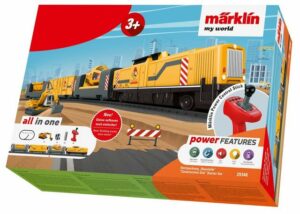

Neues für Modellbaufreunde

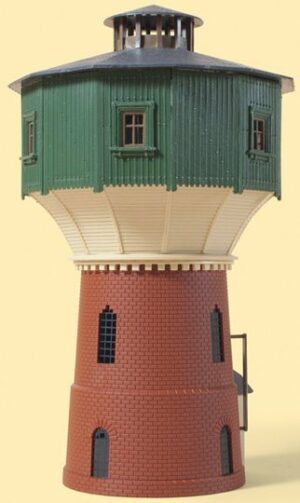

14,07 €

Willkommen bei modelleisenbahn-shop.de!

Wir sind dein Shop für alles, was mit Modellbau zu tun hat. Von Flugzeugen und Autos bis hin zu Panzern und Schiffen haben wir alles, was du brauchst, um das perfekte Modell zu bauen. Und für Modelleisenbahner haben wir eine große Auswahl an Zubehör.

Stöbere in unserer Auswahl und finde den perfekten Bausatz für dein nächstes Projekt. Wir führen Top-Marken wie Revell, Tamiya und Heller, damit du sicher sein kannst, dass du qualitativ hochwertige Produkte bekommst.